During the last years and with the new EASA regulations concerning NCC (Non-Comercial Complex), corporations and private owners of Business Jets are wondering which is the best solution to manage an expensive asset to, at the same time, comply with regulations (operational / financial) and reduce costs.

To analyse in deep NCC or Comercial operation of a Business Jet is not an easy task and it will be quite long to review any possible case. In this first article we will try to explain each option and the main differences. In the next chapter we will try to summarise some questions and answers as well as how to develop each operation in an EASA country like Spain.

To begin, we will briefly define what is NCC and what is an AOC.

Commercial Operation – AOC

We use the acronym AOC that means Aircraft Operator’s Certificate to mention that an aircraft is operating as commercial under this certificate. This certificate is granted by the local Civil Aviation Authority on behalf EASA to those companies that comply with Air-OPS regulations. This certificate allows these companies, “Operators”, to manage the full aspects of the operation and to “sell” the flight to potential final users: “passengers”. All airlines operate under this certificate.

In business Aviation we can find different types of Operator. We will define three main models based on the type of client and aircraft ownership.

Operators without aircraft owned: The aircraft belongs to a company or individual, that we can considered the “owner” regardless of how the aircraft has been acquired (purchased, leased, etc.). The owner grant the aircraft to the Operator through a contract, to manage all technical and operational aspects of the aircraft. Then the owner can decide that the aircraft is only used by him, or his company, or chartered to others under certain conditions. In this model, final user is the owner of the aircraft in many cases and can participate in every important decision. TAG Aviation is an important operator with this model.

Operators with aircraft owned. The Operator directly purchase or lease the aircraft and charter to individuals or companies. This model is similar to commercial airlines but using Business Jets. In this model, final user has no relation with the aircraft. Vistajet is an example of this kind of operation.

Fractional ownership. The operator sells fractions of specific aircraft to the final user that is a mix of owner and passenger. The Operator manages all aspects of operation. Netjets is an example of this model.

Private Operation – NCC / NCO

We are beginning to call this operation NCC, at least in Business Aviation in Europe. NCC means for EASA “Non-Commercial operations with Complex motor-powered aircraft”. This means any aircraft with any of these characteristics:

Take off mass exceeding 5700 kg (NCC), Take of mass lower 5.700 Kg (NCO)

More than 19 passengers (NCC)

Certified for operation with minimum crew of at least two pilots

Equipped with one or more turbojet engine or more than one turboprop engine (NCC).

Most of Business Jets operating in Europe comply with one or more of these conditions, so they must comply with NCC regulations if operating as private.

What is the main difference between both models? The main difference is that an aircraft operated under an AOC can be chartered to third parties while an aircraft under NCC can be only used by the owners. There are other important differences that we will analyse later, but this is the main one. It is clear that for the second and third kind of operation we analysed before, the only right answer is to operate under an AOC but, in the first model, you can choose AOC or NCC.

The question that any Business Jet buyer must answer before operating his aircraft is: what option will better adapt to my requirements? This is not an easy question and there are different answers depending on the nature of each operation and each user/owner.

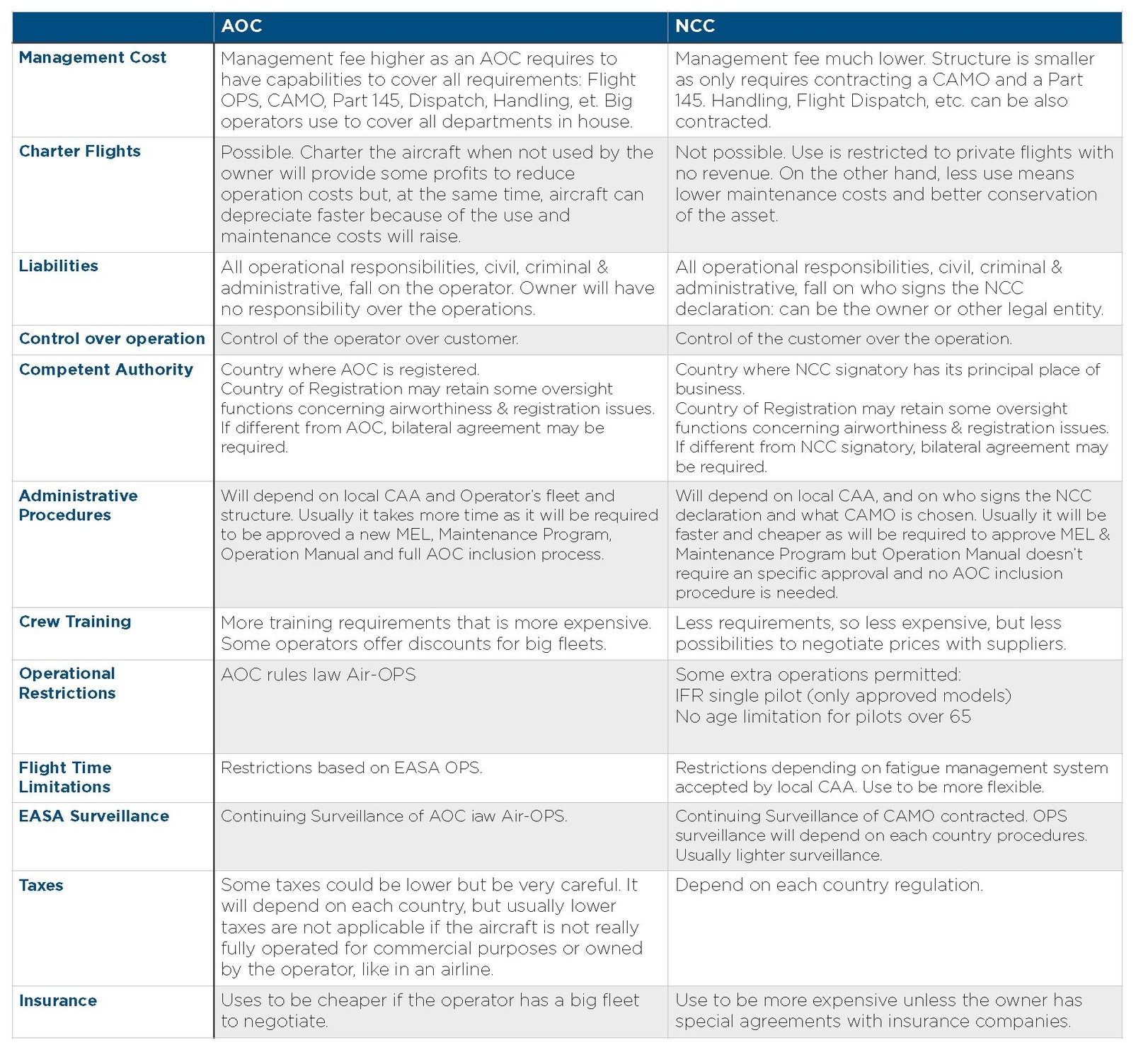

We will summarise some advantages and disadvantages of each operation and we will leave for the next chapter how can these characteristics adapt to each user’s profile. This is a general list and doesn’t pretend to be the “definitive list” but can give an idea of the usual characteristics of each option.

In the next chapter we will analyse the situation of the procedures in Spain and will try to discuss more in deep some of the differences as well to analyse some practical cases.

One critical advice: Don’t trust anybody that recommends you one option or the other before analyzing your individual requirements.

You can lose hundreds of thousands of euros by choosing a wrong option. First, gather a good team that includes impartial experts in air law, financial/tax issues and engineering. They will help you to avoid expensive mistakes and choose the best option that suits your requirements.

Please ask us for offer and we will send you a detailled offer which will meet your requirements